December Intown Market Report

By Bill Adams, President

As we approach the end of 2025, the Intown Atlanta single-family residential market remains healthy.

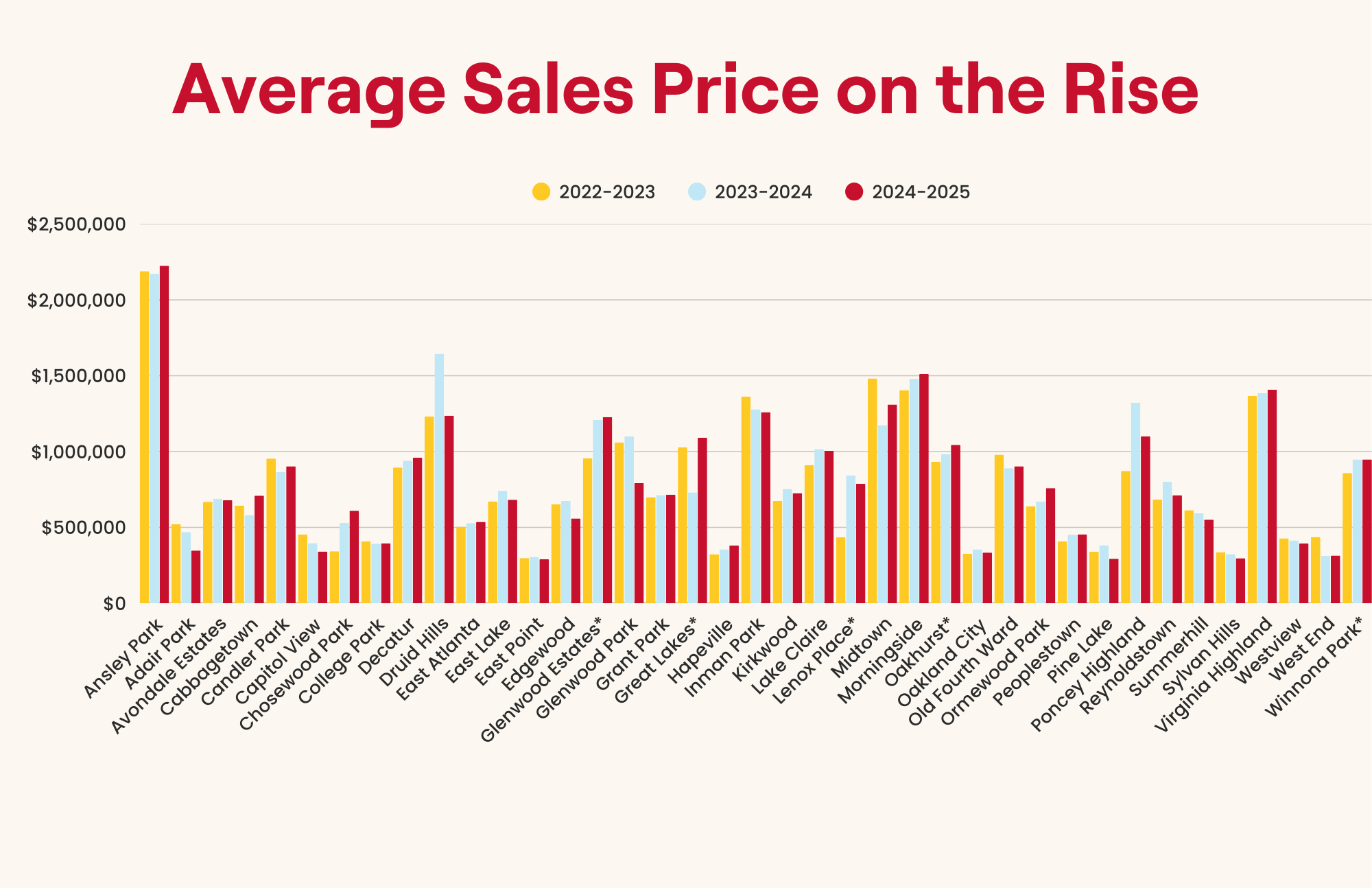

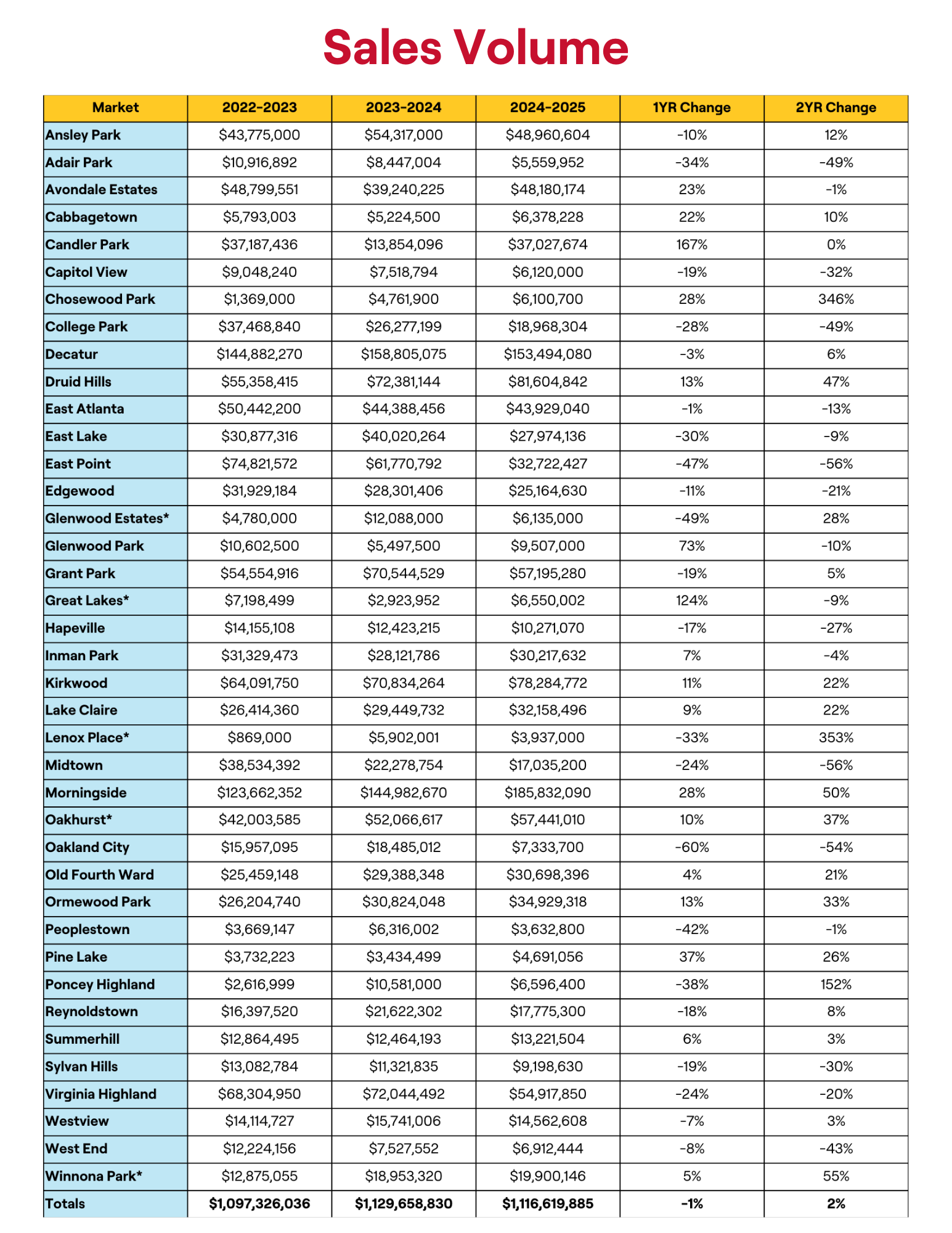

The Average Sales Price for the market is $827,126- a 5% increase over the last year, a 14% increase over the last 24 months and $2,183 more than last month’s Average Sales Price. The Number of Days on the Market has remained stable at 43 days, an increase of 8% in the last 12 months. In the last year 1,350 homes sold, representing a 5% decrease since December 2024 and an 11% decrease in the last two years. Seven fewer homes sold over the last 12 months than were reported in last month’s survey. In a sign of some softening in the market, twenty of the communities in this report experienced either a reduction in Average Sales Price or no change in ASP over the last year.

As promised last month, I will be using my “cloudy” crystal ball to make a prediction about the 2026 Intown Atlanta Market. Before looking ahead, let’s revisit my predictions for 2025, originally made in the January 2025 report.

For 2025, I predict that interest rates will make it down to the low 6% range. The number of transactions will increase from the 2024 low point by at least 10% and the days on the market will fall back into the thirties. I expect that Intown Atlanta house prices will increase by at least 5% and closer to 10%.

Last December the 30-year fixed home mortgage rate was 6.69%. The rate is currently 6.27% so I was correct that interest rates would fall, although I expected them to be closer to 6.0%. I was overly optimistic regarding the number of transactions which fell by 5% instead of increasing by 10%. The days on the market remain in the low forties instead of falling into the thirties as predicted. On the other hand, I did correctly hit the low end of my expected price increase: home prices rose by 5%, though not the more optimistic 10% I had anticipated.

This year has been a time of transition for the residential real estate market. Sellers may still occasionally receive multiple offers and sell above list price. However, in most cases, properties are selling at or below the list price. Sellers are having to adjust their expectations regarding pricing and the pace of a sale. Overpriced listings are sitting on the market and in many cases, frustrated owners are taking their homes off the market.

Buyers , meanwhile, are facing higher prices and based on recent history, high interest rates. Yet, they are encountering less competition and do not have the sense of urgency common a few years ago. Today’s buyers are comfortable submitting below list price offers and walking away if a seller does not accept their contract. The market has shifted away from a seller’s market, though it has not yet become a full-fledged buyer’s market. This transition has resulted in a condition often referred to as “market equilibrium” a balance between sellers and buyers.

So, what is my forecast for the 2026 Intown Atlanta Market? I anticipate that interest rates will track within a narrow band around 6%, assuming that erratic federal policies do not undermine investor confidence in US Treasury notes, particularly the 10-year note. I expect transactions to increase by approximately 5%. The number of days on the market may drift upward into the mid-forties compared with the low forties today. Price bifurcation will continue, with some communities experiencing price growth and others facing declines. Demand for Intown homes remains strong and I expect that the overall Average Sales Price will increase by about 5%.

Next month we will look back on the full 2025 calendar year, as the January report is the only survey that reflects a complete calendar year of activity. As noted, before, the other eleven monthly reports are based on the Trailing-12 months. In January, we will also examine the underlying factors driving price declines in some communities.

Our team is always standing by to answer any real estate questions you have and to support all of your real estate needs. We’d love for you to be in touch.