January Intown Market Report

By Bill Adams, President

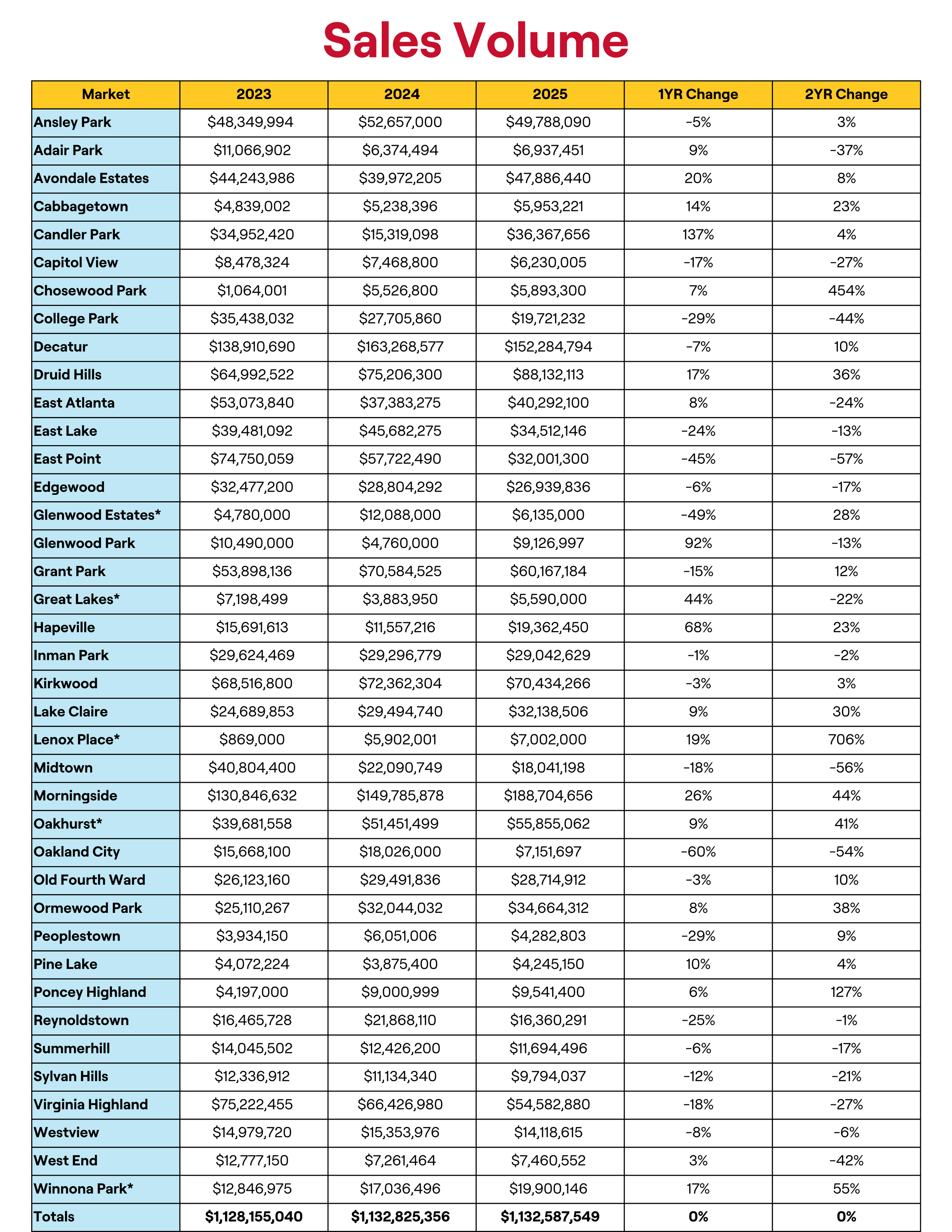

As we look forward to 2026, our January Intown Market Report allows us to reflect on the year 2025. As noted previously, our reports use a trailing 12-month methodology, and the January report is the only one that encompasses the full prior calendar year.

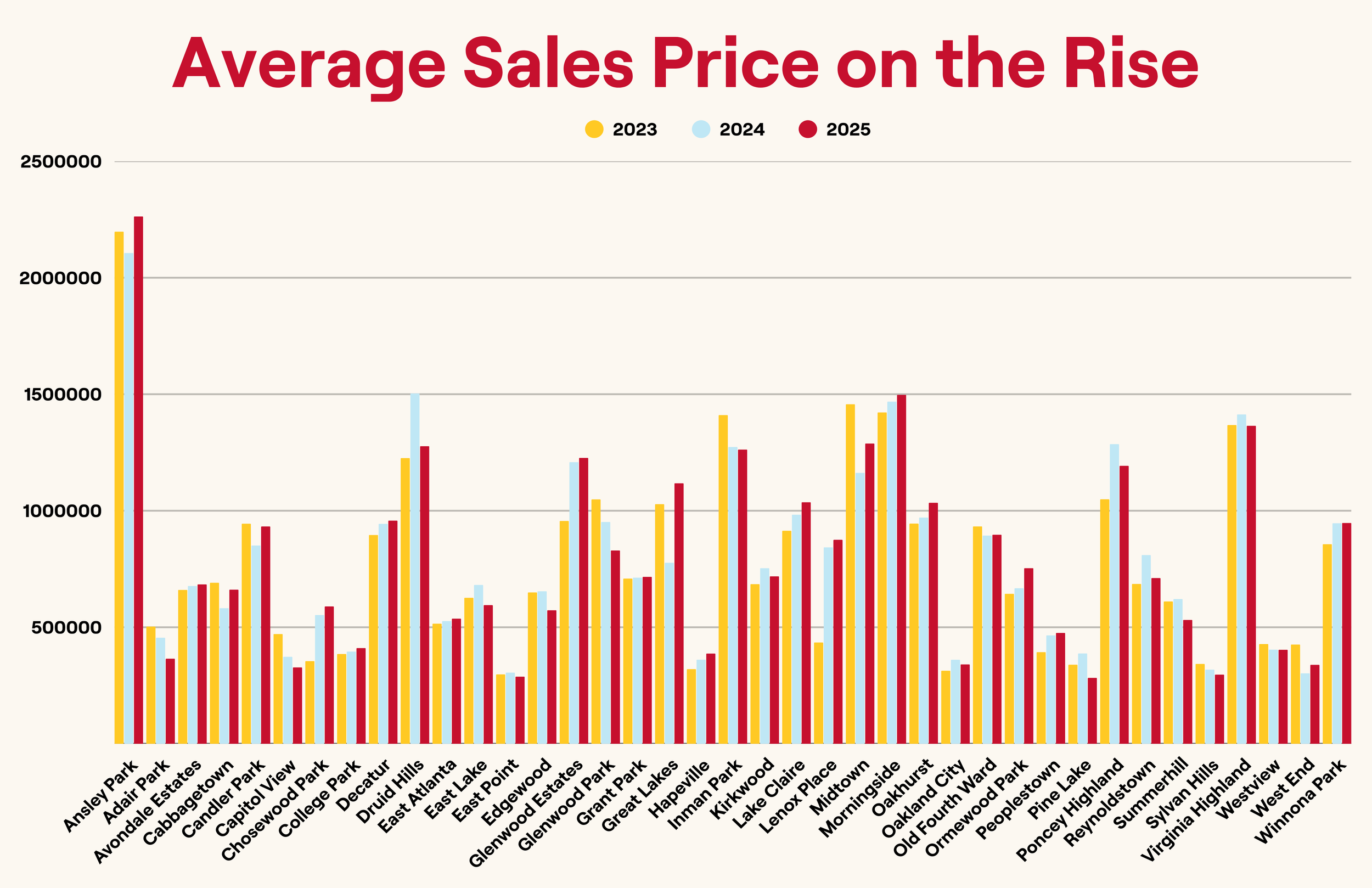

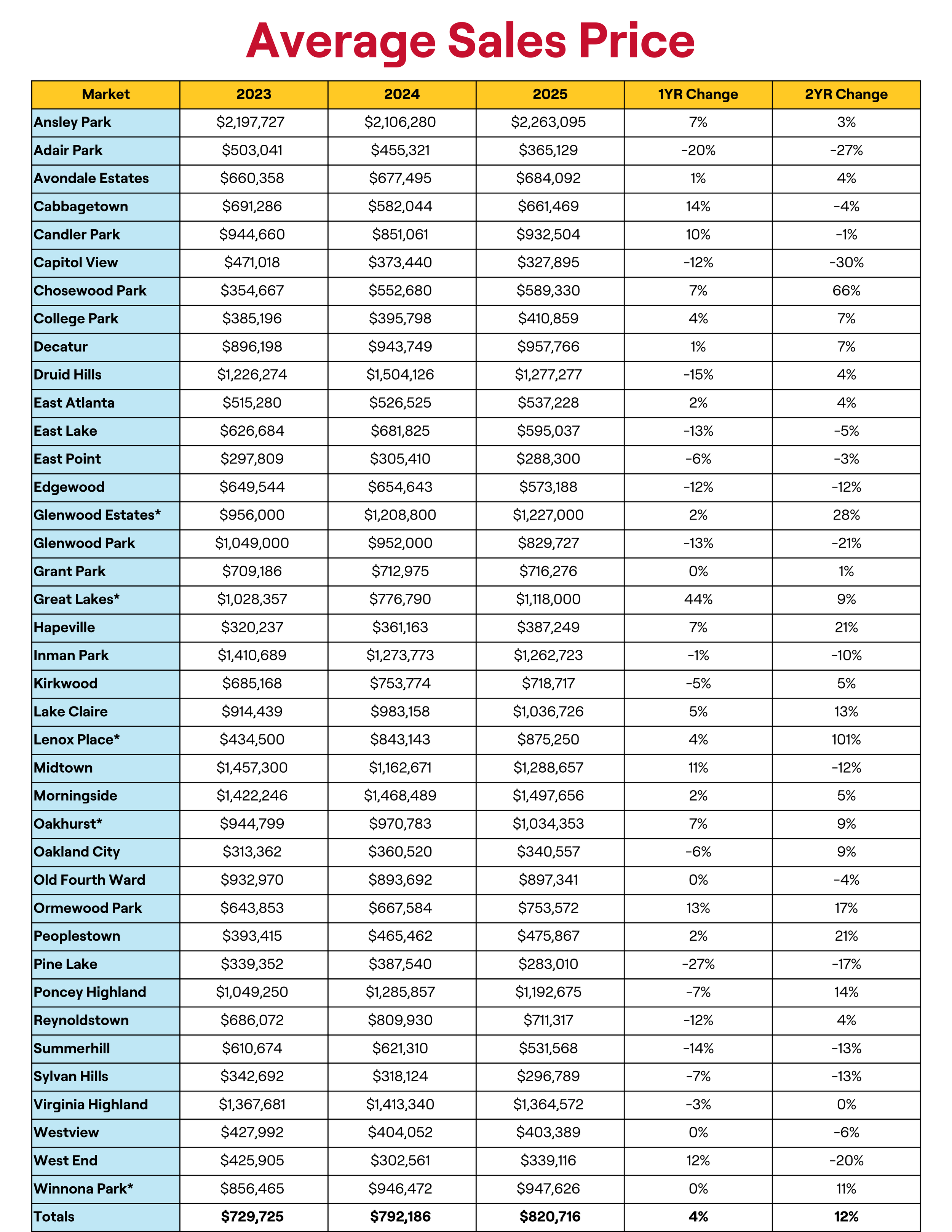

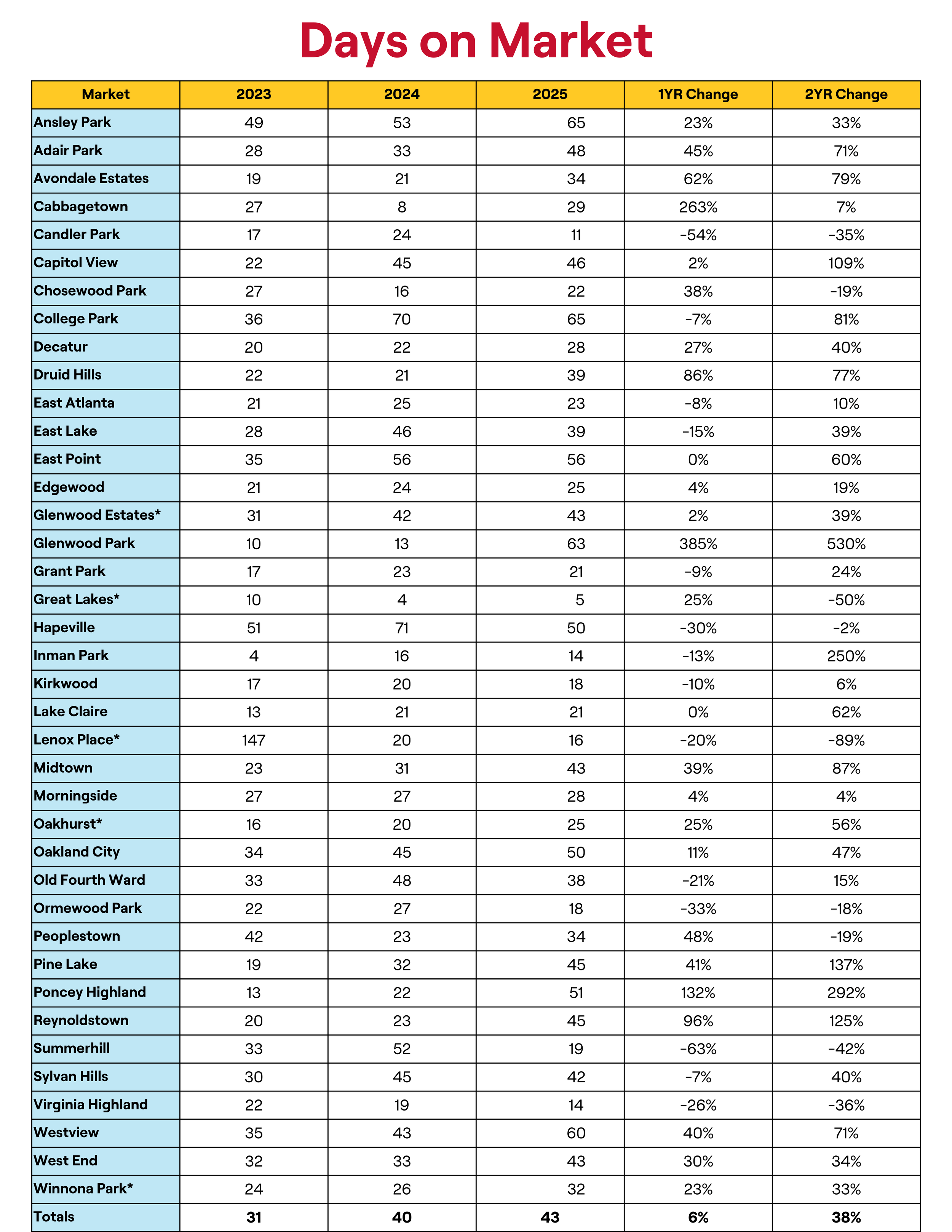

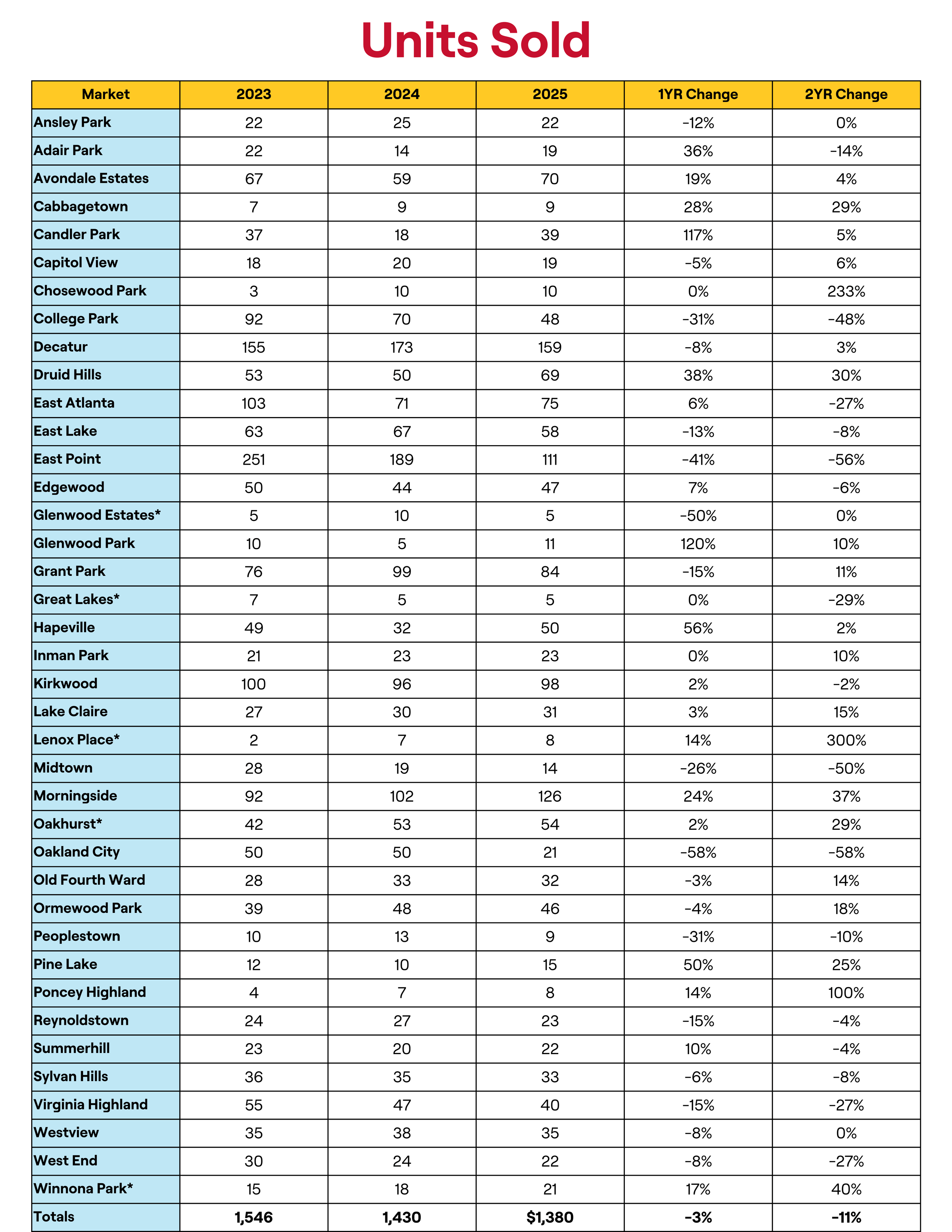

The Average Sales Price (ASP) for 2025 was $820,716, representing a 4% year-over- year increase and a 12% increase over the past two years. The average number of days on the market increased to 43 days, and 1,380 properties sold during 2025. In last January’s report, the Average Sales Price experienced a year-over-year increase of 9%, days on the market averaged 41 days, and the number of transactions totaled 1,413 units. These figures indicate some weakness in the Intown market, as the rate of ASP growth is slowing and fewer transactions are occurring.

Last year, a total of seventeen markets experienced a decrease in Average Sales Price, with nine markets suffering double-digit declines. In some cases, the dip in pricing may simply be a matter of mathematics. Smaller markets with a limited number of transactions can be subject to significant positive or negative swings in Average Sales Price. A good example of this is Poncey-Highland, which recorded only eight sales in 2025.

In the early 1990s, the real estate recession triggered by the Tax Reform Act of 1986 caused some emerging neighborhoods to lose value. In East Atlanta, for example, investors purchased foreclosures but were often poor stewards of the homes they acquired. The result was a decline in neighborhood desirability. A similar phenomenon could be occurring in some gentrifying markets today. More likely, however, certain communities may have reached a price ceiling that buyers are unwilling to exceed, leaving some sellers to consider reducing their asking prices if they need to sell.

Our company experienced a 14% increase in residential sales last year, and early indications suggest that 2026 will be a strong market. Interest rates appear poised to drift slightly below 6%, which may bring more buyers into the market. While it is a long way to December 31, 2026—and much can happen that will affect the Intown Atlanta market—being an optimist, I believe the positives still outweigh the negatives. I see the glass as half full.

Our team is always standing by to answer any real estate questions you have and to support all of your real estate needs. We’d love for you to be in touch.