July Intown Market Report

By Bill Adams, President

This month, I will be taking the temperature of the Intown Atlanta market as we pass the halfway mark of 2025. I will also take our spreadsheet and group the Intown markets by price range to get a unique perspective on which communities are related by price.

In 2025, we have been hit by a raft of tariffs on goods that affect residential real estate construction and renovations. The 10-year US Treasury note, a key benchmark for home mortgages, has been flat or increasing slightly, instead of falling and taking interest rates down. Immigration enforcement has reduced the number of construction workers who have involuntarily or voluntarily left the country. Fortunately, at least so far, none of these occurrences have negatively affected the Intown market.

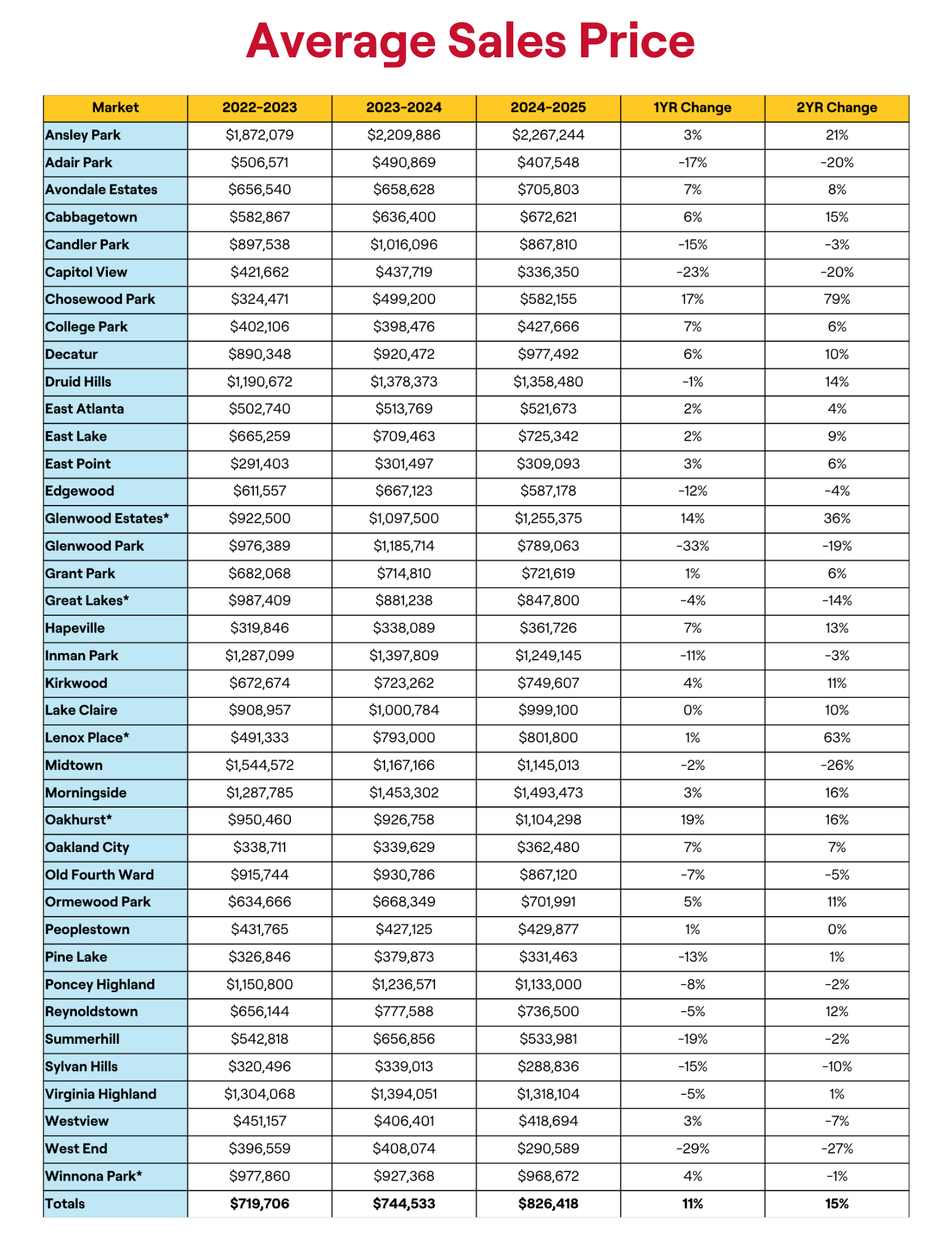

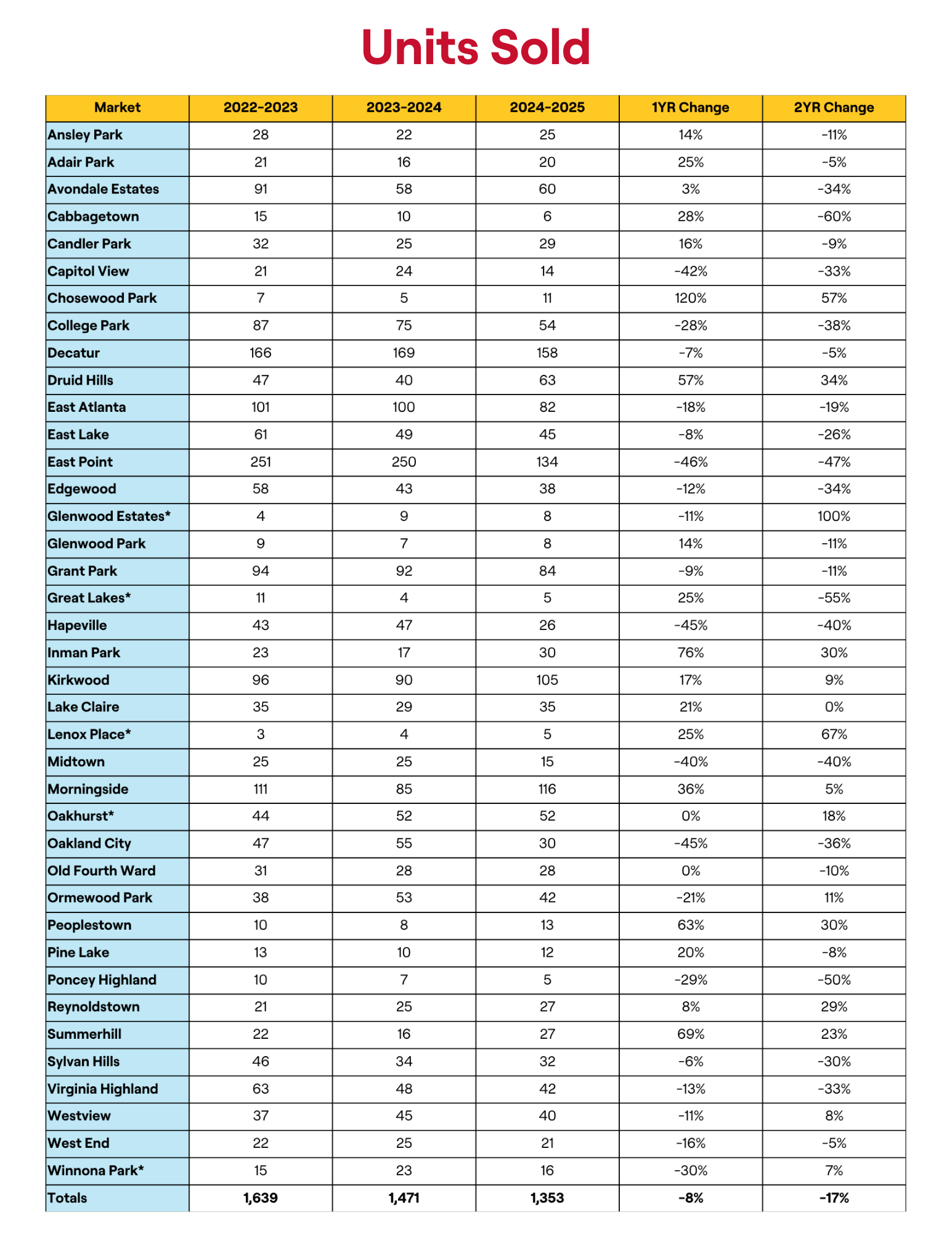

For July 2025, the Average Sales Price is $826,418, an 11% increase over the last year and a 15% increase over the last 24 months. The Number of Days on the Market is up to 41 days, a slight increase from last month. Only 1,353 properties sold over the last year, an 8% year-over-year decrease and a 17% drop in sales over the last two years. Of the thirty-nine markets that we surveyed, twenty-two experienced an increase in Average Sales Price (ASP) and seventeen markets suffered a decrease in ASP.

Below is a chart showing the distribution of prices across the Intown Atlanta market. The chart shows Average Sales Prices in neighborhoods from above $200,000 to above $2 million along with the neighborhood(s) grouped together at each price level.

The chart above provides a quick snapshot of price ranges in the Intown market. It is also a way to determine the level of affordability in each of these communities.

Finally, the data in this report is based on the Trailing-12 model and the report looks back over the preceding twelve months. Thus, the information in this report is from the first half of 2025 and the last half of 2024. As mentioned earlier, seventeen markets have experienced a year over year decline in Average Sales Price. Those markets are mostly clustered in Southwest Atlanta and Northeast Atlanta. For the majority of the communities in the report and for the market as a whole, the outlook is positive. Demand for Intown properties continues to be strong. Demand and lack of available inventory continue to drive prices upward. I expect this trend to continue throughout the second half of the year. Please let me know if you have any questions.

Our team is always standing by to answer any real estate questions you have and to support all of your real estate needs. We’d love for you to be in touch.