September Intown Market Report

By Bill Adams, President

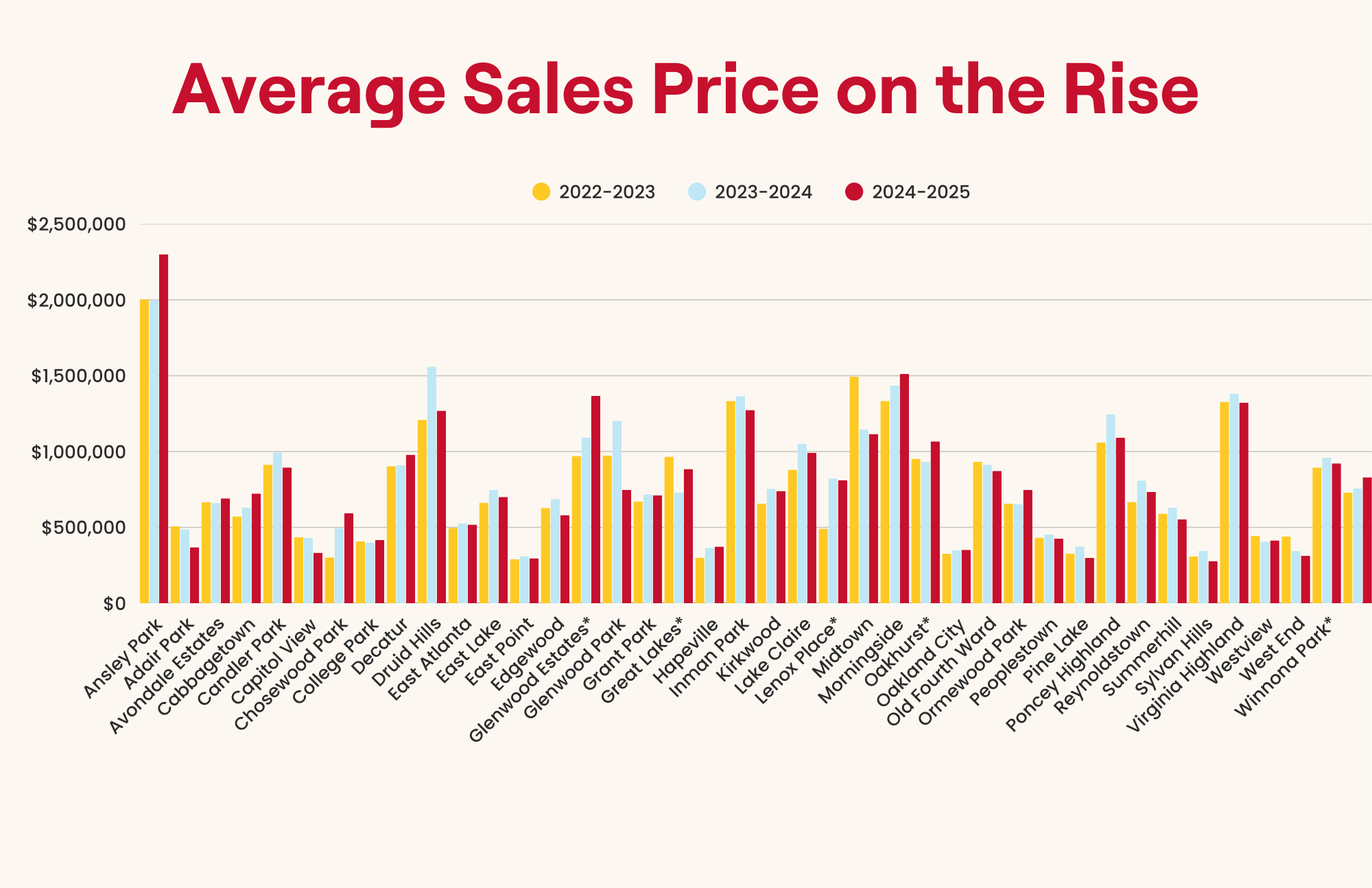

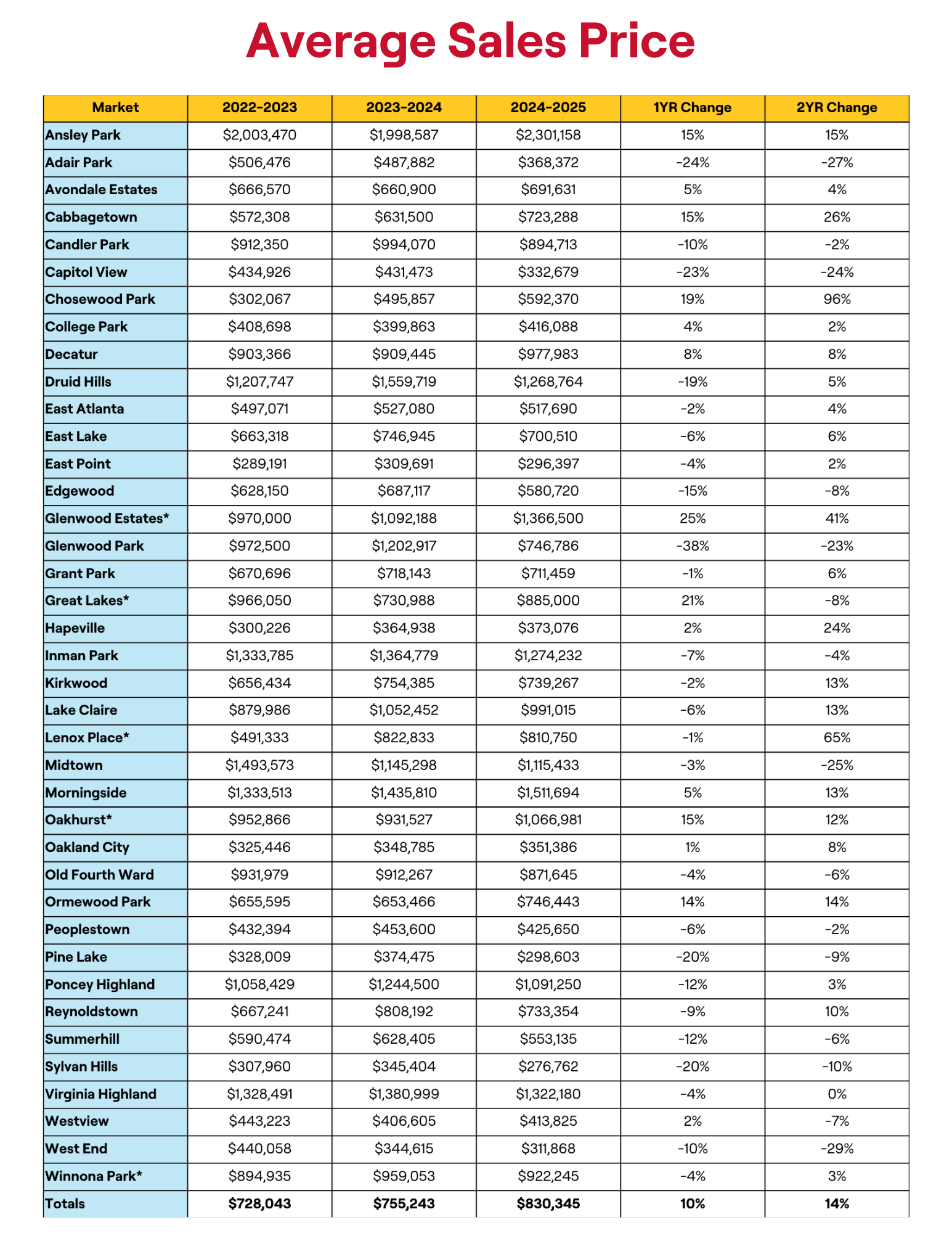

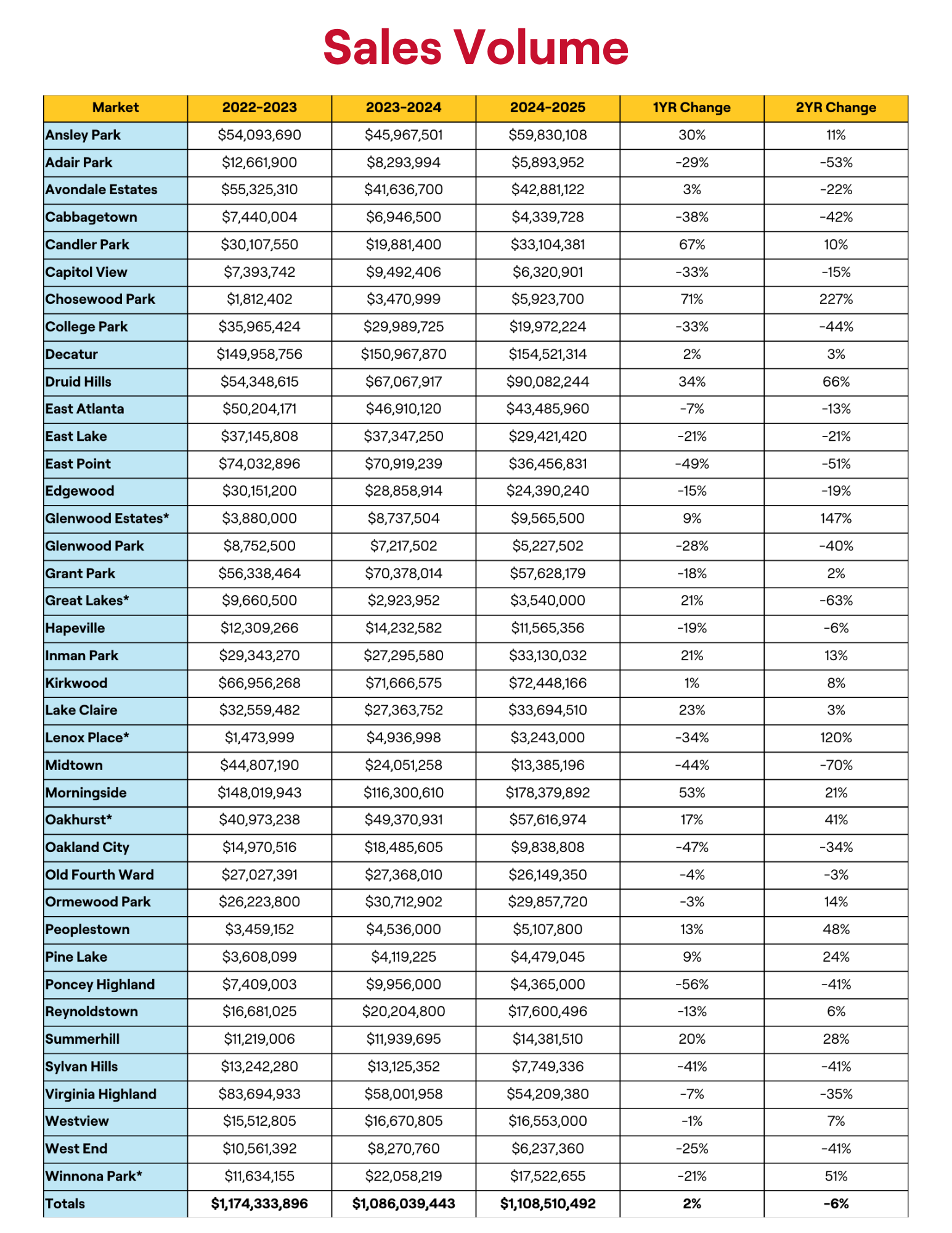

The Average Sales Price (ASP) for the overall market edged up this month by a few thousand dollars to $830,345. This is a 10% year over year increase in ASP and a 14% price increase over the last 24 months. The Number of Days on the Market increased slightly to an average of 42 days, a 13% increase from this time last year and an increase of 21% over the last two years. As mentioned in earlier posts, homes are staying on the market longer due to a number of factors, including high prices and high interest rates. The Number of Units Sold over the last year fell by 7% to 1,335 sales. This is 15 fewer sales than last month’s total and a 17% decrease in transactions over the last 24 months. This month 25 of the 39 markets that we track experienced a decrease in year over year Average Sales Price. Although the 10% year-over-year increase in ASP for the overall market would seem to indicate a healthy Intown real estate market, the decrease in transactions, the increase in time on the market and the fact that 64% of the markets suffered a decline in prices over the last 12 months, seems to indicate a weakening single family market.

This month we will “get into the weeds” in order to continue to look at some of the factors affecting affordability in the Intown Atlanta housing market. As shown in our report, the Average Sales Price in the overall market this month is $830,345. According to ESRI, a leading geographic information system (GIS) company, the Median House Value in the same market is $579,790. ESRI reports that the Average Household Income in the area surveyed in our report is $152,922 and the Median Household Income is $102,056. Using either the Average numbers or the Median numbers there is a disconnect between the cost of a home and the income of a potential home buyer. A purchaser buying the “average” home of $830,345 with a downpayment of 10% ($83,035) and a 6.4% thirty-year fixed rate mortgage would have a monthly principal and interest payment of $4,674.49. Thus, the household with the “average” income purchasing the “average” house would be spending 36.7% of their income on a mortgage payment, not including taxes and insurance. A purchaser buying the “median” home of $579,790 with a 10% ($57,979) downpayment at the 6.4% interest rate for 30 years would have a monthly principal and interest payment of $3,263.96. This monthly payment, again without taxes and insurance, would equal 38.4% of the “median” household income.

When you also factor in a significant down payment and the time needed to accumulate the funds for a down payment the idea of homeownership seems out of reach for many households.

A final statistic demonstrating the disconnect in today’s housing market is that the average age in the Intown Atlanta market is 33.8 years. According to the National Association of Realtors, the average age of a first-time buyer is now 38 years. Forty years ago, the average age of a first-time buyer was 29 years.

Last month, I promised to discuss the 10 Year Treasury Note and its effect on home mortgage interest rates. The 10 Year rate is currently falling and bringing mortgage interest rates down. This is a positive move for the real estate market, and I will put that detailed discussion off for another month.

Our team is always standing by to answer any real estate questions you have and to support all of your real estate needs. We’d love for you to be in touch.